As the economy recovers, 2021 may be a big year for middle market M&A activity. Sellers with a sound business model and healthy financial outlook are in a position to capitalize on opportunities. With the stable macroeconomic conditions, low interest rates, favorable tax treatments, and booming stock market, buyers armed with capital have increased their confidence level and are actively seeking viable investments.

Business selling process

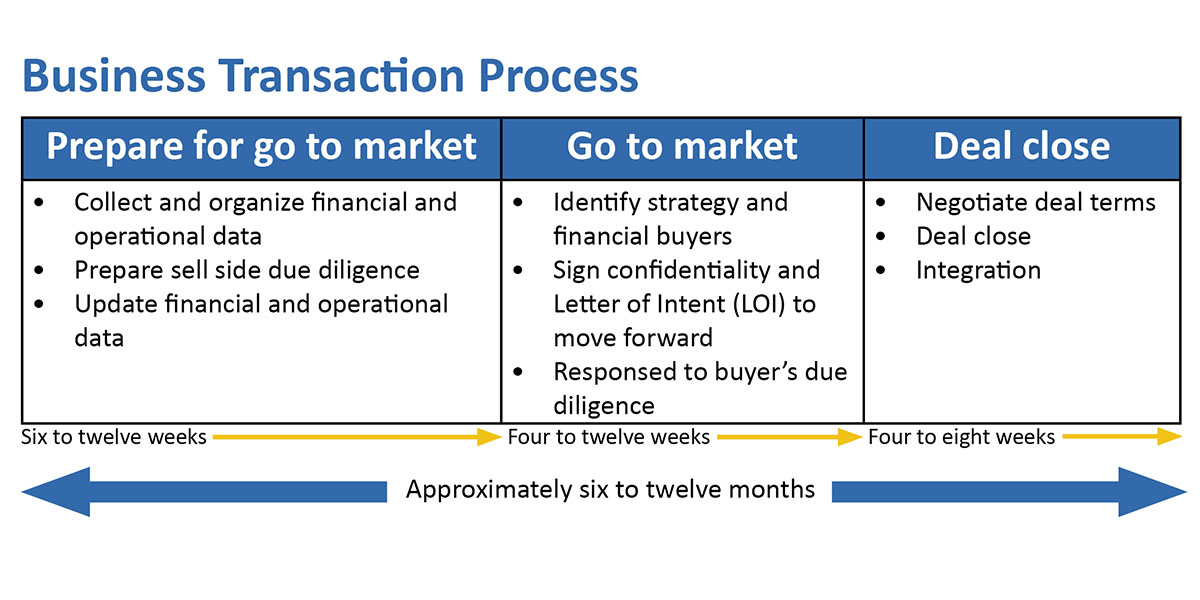

On average, a business sale transaction takes 8-12 weeks. However, it varies widely from transaction to transaction depending on the readiness of both the seller and the buyer. The chart below illustrates typical processes and timelines for a business transaction.

The first step of the sale process is to collect and organize financial and operational data. As financial data is a company’s scorecard, it is one of the very first items an interested buyer will ask to see. As such, to get the most value of the business, it is beneficial for a seller to proactively perform a preemptive quality of earnings (QofE) study.

Benefits of a pre-sell QofE

A pre-sell QofE is valuable for a seller for a multitude of reasons. It not only identifies the areas where a business can improve its performance, but also constructs a sound basis to raise the multiples in discussions with potential buyers. The sell-side financial due diligence process serves to optimize the seller’s value by quantifying and validating the current EBITDA run-rate of the business, which is used to support a higher sale price in the market. A thorough and informative QofE report will help eliminate a buyer’s predisposed risks and reduce the time a buyer requires in the due diligence process, which hopefully will result in the buyer's willingness to pay higher multiples.

Contents of a QofE report

Your QofE report should offer a quick summary of your business. Below are some basic components that are usually incorporated. The depth and breadth of each section depends on the seller’s discretion to disclose.

- Business overview

An overall description of the business, company history, management team, and products/services.

- Outline of potential sales alternatives

Is the seller open to both a stock sale and an asset sale? Are there specific capital structures or financing arrangements that the seller wants to discuss? Is the sale for the whole company or just a carve-out? These are just a few questions to consider.

- Financial data

This is the most important part of a QofE report. It provides a broad landscape of the company’s financial profile.

- Validate compliance with Generally Accepted Accounting Principles (GAAP)

- Calculate and provide support for EBITDA adjustments

- Evaluate effects of net working capital

- Bridge historical financial data to projections for future periods

- Summary of opportunities and potential challenges for the buyer

Different buyers have different objectives when contemplating an acquisition. A strategic buyer is likely motivated to focus on aspects of the company that are different from a financial buyer. For instance, opportunities for cost synergy, challenges for additional expansion to accommodate the planned growth, etc.

- Other qualitative considerations

In addition to financial due diligence, a prudent buyer will also consider non-financial characteristics of a business. Because financial data is a good indicator to understand other areas of the business, a constructive QofE report may include qualitative observations learned from the process. A few examples are:

- Commercial analysis – From a commercial perspective, a buyer may be interested in customer concentration, new products and/or services in development, percentage of recurring business versus one-time sales, etc.

- Debt and debt-like items – A buyer may exploit provisional liabilities that do not provide value to the company but rather future negative cash flow as reasons to reduce purchase price during the negotiation. Items such as pending lawsuits, commitments to purchase fixed assets, deferred compensation, capital lease obligations, or change of control payments. Those debt-like items naturally will raise buyers’ concerns in a potential transaction. Knowledge of possible resolutions or seller’s consent to indemnification will provide buyers some relief during the negotiation.

A well-presented QofE report will provide the buyer with a comprehensive understanding of a business’ potential value. Every business is unique, and no two deals are alike. There are nuances and circumstances in every deal that must be resolved as part of the due diligence process. Conducting a pre-sell QofE early will likely reduce the critical issues arising later in the transaction process. If you’re considering selling your business, reach out to us today. We can help guide you toward a smooth process and hopefully a successful outcome.